There’s no question that frugality is an important part of personal finance — you can’t outearn dumb spending — but trying to get rich by pinching pennies is like trying to win a car race by conserving gas. If you want to reach the finish line fast, you can’t be shy with the accelerator!

Let’s talk about a better way to boost your saving rate: earning more money.

Whether you’re self-employed or work for somebody else, your income is largely determined by three factors: your knowledge and skills, your productivity, and your ability to sell yourself to others.

If you want to earn more money, you have to become more valuable in the job marketplace – and demonstrate that value for the market to see.

The More You Learn, the More You Earn

According to the U.S. Census Bureau, education has a greater impact on lifetime earning potential than any other demographic factor. Yes, your age, race, gender, and location all influence what you earn. But nothing matters more than what you know.

How much does schooling matter? Here are some numbers from the 2014 Consumer Expenditure Survey conducted by the U.S. Bureau of Labor Statistics. (I dont have a table for more recent years, but the numbers show the same effect.)

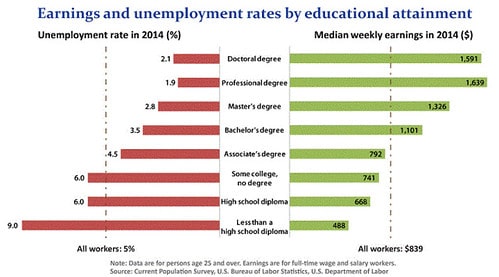

Similar research from the Current Population Survey shows that education also affects unemployment rates:

A college degree doesn’t guarantee you’ll earn more money, of course. Some philosophy majors wind up working in convenience stores for the rest of their lives, and some high-school dropouts become billionaires.

Outliers aside: The more you learn, the more you earn.

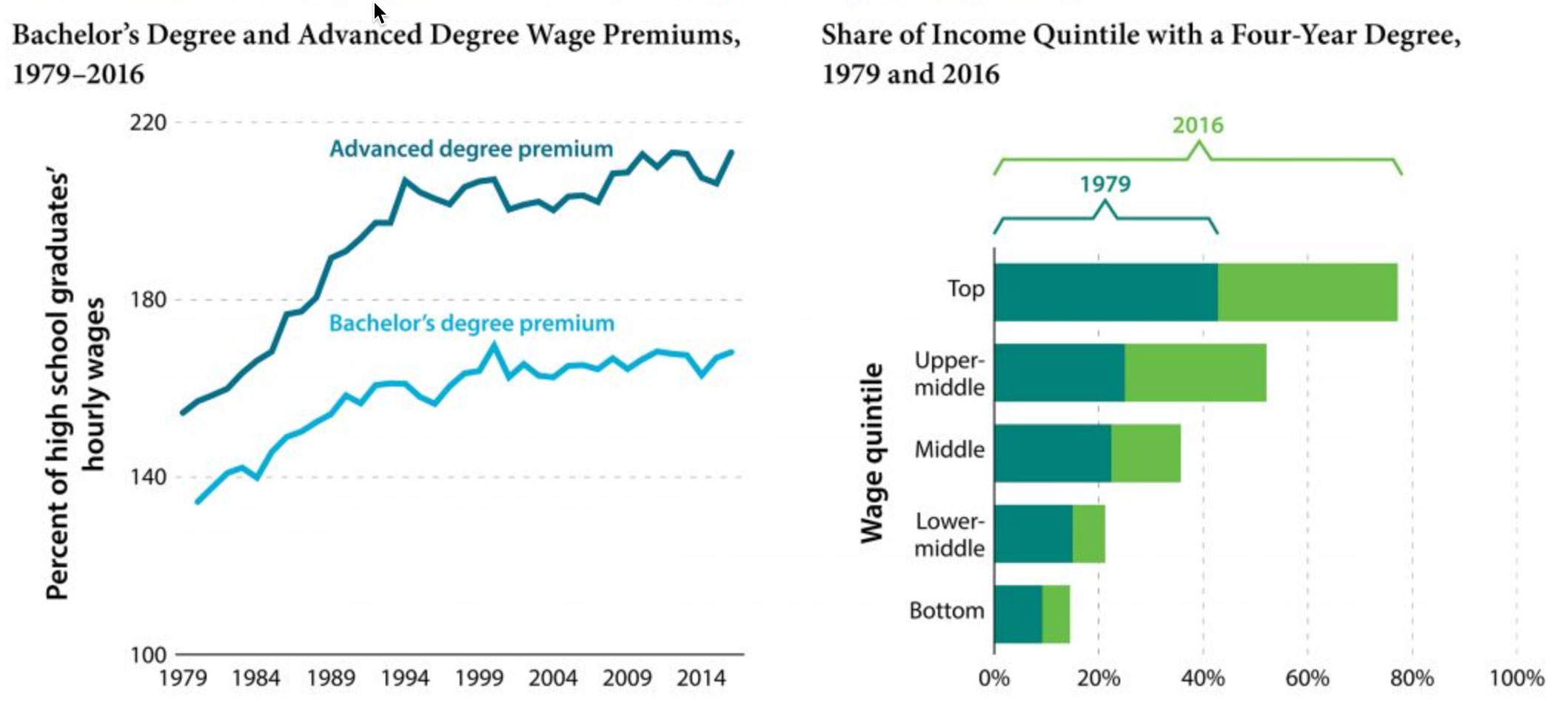

The impact of education on income has been dubbed the education premium. And while this education premium has fluctuated in recent years, it’s still very real and very powerful. Here are some charts from The Hamilton Project that demonstrate the effects of the education premium.

The best time to pursue education is at the start of your career, when you’re young. The next best time is now. I know it can be tough to find time and energy to go back to school once you have a family and career, but it can be done.

If going back to school appeals to you but you don’t know where to start, here are three options to consider:

- First, the U.S. Department of Labor has a website with all sorts of resources for people looking to improve their job prospects.

- Next, some universities offer full-fledged degree programs through dedicated online courses. And this isn’t watered-down stuff, either. Johns Hopkins University, for instance, offers a complete online master’s degree in nursing.

- Finally, your local community or junior college is always an excellent and affordable source of quality continuing education.

Many colleges and universities – including big names like MIT and Harvard – have begun sharing free courses on the web. These so-called Massive Open Online Courses (or MOOCs) are an excellent option for adults already busy with Real Life and a career. For more info, check out mooc.org or edX. Or there’s LinkedIn Learning, which provides targeted short courses on skills useful to working adults.

Ultimately, education is no panacea. It’s not a shield against job loss or low pay. But the evidence is overwhelming. If you want to make more money, go back to school.

Sell Yourself

Your income is dictated by the value of your work, and the value of your work is determined by your education and productivity. But there’s one last piece to this puzzle. Your income is also influenced by how well you market yourself.

Like it or not, you are a product. Your work and expertise are a commodity. If you learn how to sell yourself to current and future employers, you’ll make more money. One of the best ways to do this is by learning to negotiate your salary.

In his excellent book Negotiating Your Salary: How to Make $1000 a Minute, career coach Jack Chapman promotes a five-step process that almost anyone can use:

- Delay salary discussions until after you’re offered a job. (Same with raises: Discuss a pay increase after your performance review.)

- Let them make the first move. The first person to name a number loses, so always let the employer suggest a salary first.

- When you hear the offer, repeat the top value — then stop talking. This “flinch” is a piece of play-acting that buys you time while putting pressure on the employer.

- Counter the offer with a researched response. Before the interview, do your homework so you know a reasonable salary for the position. Use this knowledge to ask for more. (Start your salary research at sites like Glassdoor and PayScale.)

- Clinch the deal — then deal some more. After you’ve locked in your salary, negotiate additional benefits like extra vacation days or a company car.

According to a 2011 study in the Journal of Organizational Behavior, failing to negotiate your starting salary can cost $600,000 during the typical career.

Only about half of all Americans negotiate their salaries. Some can’t, of course. Not all jobs allow negotiations. But if you can negotiate and don’t, you’re costing yourself big bucks. It’s worth taking the time to practice this skill.

I feel strongly about this subject that I collect articles about salary negotiation. Here’s a collection of some of my favorites.

You Are 100% Responsible for Your Income

How much you earn directly reflects what the market believes you’re worth. Your income is based on the demand for your knowledge and skills, the quality and quantity of your work, and how well you market yourself to potential employers or customers.

If you want to earn more, you must be worth more.

Nobody cares more about your money than you do. This is especially true with your income. If you don’t take responsibility for earning more money, nobody else is going to do it for you. And nobody’s going to simply hand you a pile of cash because you’re a nice person.

In a lot of ways, your career is like a game. You might not like the rules of the game, and that’s fine. But if you want to win, or to have a good score, you have to learn to play by those rules, to use them to your advantage.

Additional Resources

Finally, here’s a list of additional resources if you’d like to learn more about the concepts in this lecture. First up, here’s a great book on salary negotiation. It’s old but it’s excellent: Negotiating Your Salary: How to Make $1000 a Minute by Jack Chapman.

If you’d rather read material on the web, here are some related articles:

- Make More Money: How to Supercharge Your Income at Get Rich Slowly

- Education Impacts Work-Life Earnings Five Times More Than Other Demographic Factors at U.S. Census Bureau

- Education and Synthetic Work-Life Earnings at U.S. Census Bureau

- The Economic Value of College Majors at Georgetown University

- The Value of a College Education at Get Rich Slowly

- The Informational Interview: A Job-Hunter’s Secret Weapon at Get Rich Slowly

- How to Answer the Toughest Interview Question at Penelope Trunk

- Salary Negotiation: Make More Money, Be More Valued at Kalzumeus

- How to Negotiate a Raise with Any Job at I Will Teach You to Be Rich

- Who Asks and Who Receives in Salary Negotiation at Journal of Organizational Behavior

And don’t forget: If you’d like some general resources for financial independence and early retirement, I’ve created a page here at Money Toolbox that links to useful FIRE apps and tools.